Budgeting & Money Management

Managing your money and budgeting effectively is a great life skill. It allows you to easily see what money you have, what your financial commitments are, and how much money you have left over for disposable income. Budgets do not have to be complicated. Simply keeping a list of incoming and outgoing money in a table will help you keep track.

What Are Financial Commitment?

These are payments that you may regularly pay and are often associated with living costs. Notable examples include rent, house bills and food. This can also include things like gym memberships, mobile phone contracts and streaming and video game subscriptions.

Prioritising Your Money

When budgeting, think about your priorities with your money. Buying a shiny new laptop might be an appealing thing to purchase with your first student loan instalment, but will it be quite as appealing when penniless at the end of term? For example, would you prefer a £17.99 takeaway pizza, or a £2.50 supermarket pizza? Although the takeaway option may be more appealing, going for the £2.50 supermarket pizza means you have saved just over £15 which you can now spend on other things.

Activity 1

List all your current spending commitments (e.g., gym memberships or phone contracts) and then rank them in order of priority. If you don’t have any financial commitments, use the list below and rank these in order of what you would prioritise.

Examples to consider: phone bill, food shop, gym membership, console subscription, rent, household bills, study books and study materials.

Budgeting

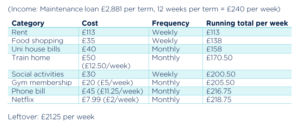

Budgeting doesn’t have to be a lengthy and complicated process. A simple table that summarises the income you have (student loan, part time job, support from family) and how much you are spending will do. Ultimately you should aim to spend less than the money you receive.

Activity 2

Based on the example above, create your own budget. For more hints and tips, check out Save the Student and Money Saving Expert.

If you are off to university or college, why not use your income from your calculated expected maintenance loan (calculate it here) and include any income you may receive from a part time job or from family.

If you spend more than your income, what could you change to ensure you remain within your budget?

Student Bank Accounts

Most students are eligible for student bank accounts. These are specialist bank accounts that include specific benefits, such as fee free overdrafts or freebies. Deals can often change, so check out Money Saving Expert for the latest information about student bank accounts.

Activity 3

Research online to find a student bank account. What benefits does this account have over standard bank accounts?

Activity 4

Find at least one other student bank account and create a table to compare the two. What are the benefits of each account?